A requiem for Indian business journalism, in the delightfully breathless style of Juan Antonio Giner, founder-director, Innovation International Media:

‘Satyam’, meaning truth.

India’s fourth largest software services provider. The darling of Hyderabad.

An outsourcing company with 53,000 employees that serviced 185 of the Fortune 500 companies in 66 countries.

A company which now says 50.4 billion rupees of the 53.6 billion rupees in cash and bank loans that it listed in assets for its second quarter, which ended in September, were nonexistent.

India’s biggest corporate fraud ever.

Hell, India’s biggest fraud ever: customers, clients, shareholders, employees, families down in the dumps.

India’s Enron.

We have heard all the big questions being asked. So far.

How come the analysts did not know?

How come the auditors did not know?

How come the regulators did not know?

How come the directors did not know?

How come the bankers did not know?

Yes. But where is the other question?

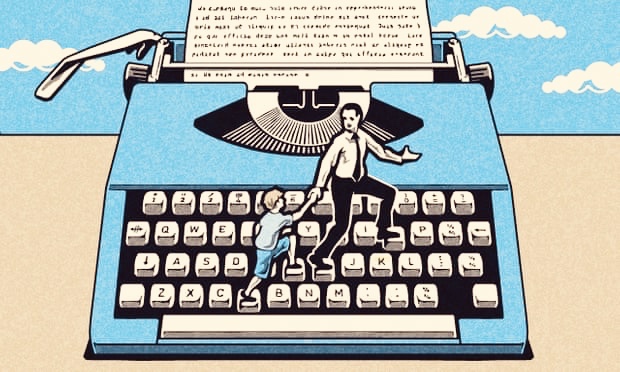

How come the media did not know?

Yes.

How come the English newspapers did not know?

# Not Deccan Chronicle, not The Hindu, not The New Indian Express, not The Times of India.

# Not The Economic Times, not Business Line, not Financial Chronicle, not Business Standard, not Financial Express.

How come the foreign newspapers did not know?

# Not New York Times, not Wall Street Journal, not Financial Times.

How come the Telugu dailies did not know?

# Not Eenadu, not Andhra Jyoti, not Andhra Prabha, not Saakshi.

How come the general interest magazines did not know?

# Not India Today, not Outlook, not The Week.

How come the business magazines did not know?

# Not Business Today, not Business World, not Outlook Business.

How come the English news channels did not know?

# Not NDTV, not CNN-IBN, not Times Now, not Doordarshan News.

How come the business channels did not know?

# Not CNBC, not NDTV Profit, not UTVi.

How come the Telugu channels did not know?

# Not ETV, not Maa TV, not TV9, not TV5, not Doordarshan

So many media vehicles, but so little light on the infotech highway yet so much noise.

But who is asking the questions?

Is journalism that doesn’t shed light journalism?

Or puff?

Or PR?

Or Advertising?

Also read: Is this what they really teach at Harvard Business School?

Excellent post. Business journalism in India does indeed equal PR-puffery in India.

A very nice postmortem on satyam fraud.

Auditor’s Independence

What is Independence, if the Auditor’s Appointment is made by the Promoter who holds majority stake or has can get through the resolution because, he is managing the company ie. a listed company.

As one of the Professional who is into company audits for the last 25 years always feel that there is clash of interest being appointed as auditor by the Promoter who holds majority stake or he has a say in the company because he can yield pressure on appointment in the General Meeting.

I was also part of the Audit Team when our Audit Firm were Statutory Auditors and Audited Banks and Companies like State Bank of India, Vijaya Bank, Indian Overseas Bank, BEL, HMT and other Government Organizations. Here the joint auditors used to work as team, with discussion jointly we used to identify the areas where we need to concentrate more and get information from the company / bank. Audit finalization was done with mutual consultation on matters which we need to qualify based on Materiality and other factors.

If an analysis is made on the Quality of Reporting on these Public Sector Companies and the Audits made by the Big Four, the Quality of Reporting of Auditors who are not part of Big Four, surpasses the Quality of Big Four by a Great Margin.

Solution lies within the Shareholders and Investors of all listed entities to Identify an Audit Firm who are not part of Big Four and make them Joint Auditors along with Big Four who are already Auditors in that company on doing this there will a change in the reporting pattern to the Share Holders and Investors or there is already a Body already which appoints Auditors for Public Sector Banks and Companies which can be tapped to get the information on Auditors who have a good track record on Audit of Companies.

To Avoid major mishaps in the financial reporting, Appointment of Joint Auditors of 2, 3 or 4 etc based on the Turnover of the Enterprise is very important as one auditor will not be able to exercise independence and report in the factual matter.

I request all the Investor community to look into this and implement the suggestion given so that Second Satyam Fiasco will not Happen Again.

Jai Hind

M.R.Jayaprakash

Chartered Accountant

Bangalore

very true write up…

our journalists are indulged more into hollow news, and news channels are stressing more on the Masala issues. so it has become easy for j-lists to get a masala news and earn name. and here our journalism which is said Fourth Estate of the country lack in covering the surface subjects which effect our lives.

The company auditors should not be selected by the company. It should be appointed by the Government. For big companies, the audit should be done by auditing companies from other countries, who do not seek favors in getting the particular companies auditing function. No company should audit the same company for more than three consecutive years. There should be a second level opinion by another auditing company to see that the data submitted are correct and that the auditing function has been checked correctly. There should be also surprise audit by “honest government auditors”. I also do not know if there are any government auditors who are honest any.

There should be a number of checks and oversee at every stage. This whole fiasco makes me feel that those who live on others hard earned money always commit fraud.

Lawyers used to be most dishonest. Now chartered accountants have joined the forte.

What are the functions of Board of Directors of the company?

Also allowing other company MD’s like Infosys, HCL, TCS and others also is not a good idea. Because we do not know yet, how much fraud they have committed to survive in this IT industry to get foreign contracts and for successful outsourcing.

Fourth Estate is also corrupt. Watch Indian Television News. Most of them are horrible; they support only the position of their company. The newsmen in India are not honestly portraying news.

India has lost is moral authority.

Madoff, right under the eyes of SEC, regulators and the Federal commissions, conducted a $50 Billion scam, and every one turned a blind eye. Even when analysts warned SEC of a scam amny times, Madoff was not investigated. Satyam is nothing conpared to it.

Larger industrial houses such as Ambanis have done this on a regular basis the l;ast 2 decades, but it has been coveed up well because they were able to bring in funds when required. Raju was exposed only because he overstretched himself on Satyam and Maytas account. He had to pay the state government Rs.2000 crores(10%) upfront to get the state govt contracts for Maytas. No wonder when the cash crucnch came, he had no where to go.

atleast Madoff is in Jail and the investors have got / going to get their money back. Mr satyam is still in an A/c jail … this is India.